A really fun article which I stumbled upon late Saturday evening:

NY Times: Boomerang Kids Won’t Leave

I could go on and on about the scam that college debt has become, but I promised myself I wouldn’t do that again. Fact is, this country just moves from one bubble to the next, and Today’s Bubble™ is college debt.

I could go on and on about the scam that college debt has become, but I promised myself I wouldn’t do that again. Fact is, this country just moves from one bubble to the next, and Today’s Bubble™ is college debt.

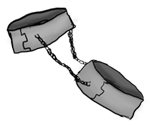

The article itself is a hoot. But I also highly recommend that you take a look at the 14-photo slideshow which accompanies it, because there you’ll unearth gems like this one from Alexandria, 28 years old, the proud owner of a $90k student-loan chain around her neck:

Oh, Alexandria. As Upton Sinclair so succinctly put it, “It is difficult to get a man to understand something when his salary depends on him not understanding it.” The same goes for education: Don’t expect colleges and the rest of the “Big Education” industry to teach you all that basic financial and debt stuff, because their salaries depend on you NOT learning it.

At least, not until you’ve run up student loans to the hilt and paid off all your bursar and textbook bills.

RogerR wrote:

I find it interesting that no one gets taught anything about finance in school anymore, This should be the first thing taught in freshman high school, I graduated in 1977 and it still took a while to get the loan thing but I knew people that thought as long as you had checks it was ok to use them whether you had money in the bank or not. the first house I bought I finally figured out that over 30 years at 6% it would cost over 3 times as much as the list price.

Luckily when I graduated college I only owed 15k I can’t even imagine getting a job to live on and pay off 90k in debt at 12% interest. That is robbery.