Review: YNAB 4 Budgeting Software

| Creator/Producer: | Jesse Mecham | |

| Latest Date Tested/Software Version: | March 2013 / Version 4.1.553 | |

| Website: | YouNeedABudget.com | |

| Price: | $ | |

| Review Last Updated: |

I think I've written about as many accolades as I can about YNAB software. I've followed the evolution of YNAB all the way up from its initial spreadsheet form, through its leap into standalone software (YNAB Pro), and then most recently, YNAB 3.

Now YNAB 4 has graced my Windows 7 desktop, and yet again, I'm awestruck. Time for a YNAB 4 review.

Note: I'm Still a Quicken Guy.

As usual, I'll preface my YNAB 4 thoughts by stating, up front, that I'm a Quicken guy, and have been since the mid-1990s. As I write this, Quicken Deluxe 2013 is my default money-management solution.

However, it's my experience that Quicken is SO AWFUL and cumbersome at budgeting that even I — a devoted Quickenhead — took the time to build and use my own Excel spreadsheets (rather than Quicken) back when my family was working our way out of debt (and into savings).

Looking back, if YNAB 4 been around then, it's what I would've used instead.

Video Review: YNAB 4

Those of you who'd like to watch my video review (~17 minutes) of YNAB 4 can get it here:

Note that I don't script these video revies; I just put the software through its paces and talk about what I see. To view the YNAB 4 video in larger formats, you can visit this page for the larger options.

(A relatively new browser is required, as I'm using embedded HTML5 video.)

YNAB 4 Isn't ...

YNAB 4 is an extraordinary budgeting and cash-flow tool. It is not an "Analyze my spending six levels deep" tool; see "One Budget to Rule Them All" below for more on this.

YNAB 4 is also not meant for tracking investments, tax deductions, business profits and losses, or anything remotely close to that.

It is meant to help you gain, and keep, total control of your spending. (And by extension, your life. That's just the honest truth.)

YNAB 4: Cleaner, But Still Freakin' Beautiful.

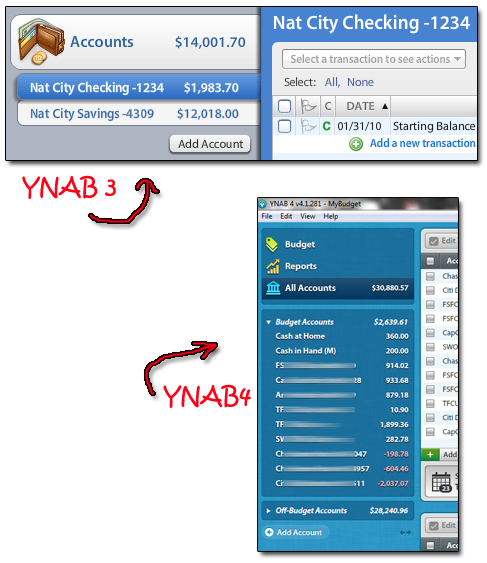

I'm thinking that Jesse Mecham (YNAB owner/creator, whom I've interviewed) and the other kids at YNAB made an effort to "simplify" the interface in this newest offering. If so, it shows. There's a much better use of space in YNAB 4 than in its predecessors. I notice this mostly in the left sidebar's account listing.

Some icons, although pretty, got cleared away, so now you can see more accounts at once. As a guy with more bank accounts than Donald Trump, I'm appreciative.

Ah, Registers. Sweet, Sweet Registers.

Let's take a gander at an account register in YNAB 4:

Very, very nice. To start adding one or more transactions, just click the "Add a new transaction" button in the register. Same goes for adding a transfer — there's a button for that. YNAB 4 can also hide/unhide reconciled transactions, if you like.

Look closely at the register screen above, and you'll see the "Scheduled Transactions" section at the bottom of the window. That section can be hidden/unhidden with the click of a button, too.

Click here to see the "Scheduled Transactions" section more closely:

And the button that can hide/unhide it:

If you're looking at a specific account's register, its "Scheduled Transactions" section will show only those scheduled transactions which affect that account. To see all your scheduled transactions in YNAB 4, just click the "All Accounts" icon in the sidebar. It's totally sweet: Doing so shows you ALL accounts' transactions in the register view at once, as well as all of your Scheduled Transactions.

(Note, too, that when you have the "All Accounts" register open, you can add transactions and transfers to ANY account right from there. There's no need to click on each account, one at a time, to add transactions to them. That'll save a few clicks, won't it?)

A Bit More About Scheduled Transactions.

You can have YNAB 4 enter your scheduled transactions into the register early, if you like. If not, then YNAB 4 enters your scheduled transactions into your chosen account register automatically, on the day and recurrence you designate.

However, once that day comes, and YNAB enters the transaction, the transaction isn't really final. You'll still need to click an icon (easy to spot) to verify and accept the transaction. (Or skip it, if needed.)

Keep doing this crap, Intuit, and Quicken 2013 will be the last Quicken I ever buy. YNAB 4 will be my new choice.

One Budget to Rule Them All

As sweet as the registers are, it is, as ever, budgeting where YNAB 4 crushes all competition. And I do mean CRUSHES.

Click this image to see the YNAB budget layout up close and personal:

YNAB 4 comes to you with a default set of budget/spending categories. They're pretty basic, and you can edit, delete, or add to them at will. I edited mine up quite a bit to mirror (and simplify!) the categories I use in Quicken.

Unlike Quicken, spending categories only go two levels deep in YNAB. There are Master categories, and subcategories beneath them ... but nothing below that. So if you insist on categorizing your food spending down through five levels of categories, subcategories, sub-subcategories, and so on ... well, YNAB 4 isn't for you. It doesn't provide that functionality.

Why? Because the goal here — and this is vital — is simplicity. Which typically leads to crazy-effective budgeting.

In my Quicken life, I've accumulated hundreds of categories over the years. Some of them go three levels deep. However, creating "similar" and more-basic categories in YNAB was very easy. I just have to give up a bit of detail, which, if I were dependent on building and sticking to a budget these days, I would happily do.

(And really, if you're wanting five levels of subcategories for your food spending, you really ought to consider what exactly it is you're doing with your life. 'Cause that's just sick, man.)

Budgeted Categories in Action!

Take a look at this pic:

Here I've created a "Food" Master Category, with subcategories of "Groceries," "Dining Out (Wkday Lunches)," and "Dining Out (Other)." That breakdown, I've discovered over the years, tells me all I need to know about my household's food spending. No real need to go deeper in detail that that. I've budgeted $500 for groceries, $100 for weekday lunches out, and $200 for other dining out. No spending has yet taken place in these categories, as evidenced by blank spaces in the "Outflows" column of those rows. As the month progresses and we spend money in these categories, YNAB will tally it in the "Outflows" column.

Same goes for our housing expenses, as shown by the "Housing" Master Category. I could have more than three subcategories here if I wanted. But for now, these three ("Mortgage/Fees," etc.) do the trick.

At the top of the February budget column, we see this summary:

Since a key tenet of the YNAB plan is to "Live on last month's income," what we see there is that my household will be using January's (fictional) budget surplus of $3,667 to live on in February. We've also had (fictional) income of $25.35 in February; that too adds to February's budget total. (I could have elected to attribute this $25 to March's income, if I'd wanted.)

February's full budget (with some categories collapsed to save space) looks like so:

So for February, we have a total of $3,692 to budget for the month. I've assigned all but $26.14 of that to our various categories. So, in YNAB parlance, I've "Given every dollar a job." (Almost!)

Add Notes to Your Budget

YNAB also allows folks like me — who can barely remember to put our socks on in the morning, much less figure out why we budgeted an extra $100 for cosmetics two months in advance — to add text notes to our budget categories. Below I've added one regarding a planned higher-than-normal "Personal Care" expense:

You can add notes to each category, if you like. You can also add notes to each month's budget header. I cannot tell you how tremendously helpful this feature is. (And also how badly my memory is slipping as I get older.)

Welcome to the "Reports" Section

YNAB 4's final section, "Reports," will probably make most diehard Quickenheads yawn. There are only four reports, though they're moderately customizable. Here, for instance, is the "Spending by Category" report:

The other three reports: "Spending by Payee," "Income vs. Expense," and "Net Worth."

My guess is that these four reporting options are probably enough for 80 percent of financial-software users out there ... but more than enough for 99 percent of the folks who need YNAB's budgeting help.

And If You Need Help ...

The help/support and training sections of the YNAB website are tremendous. Before you give YNAB a shot, you simply MUST peruse YNAB Support. Check out the wide selection of videos covering just about every topic you can imagine.

During my setup of YNAB 4, I had only a handful of questions ... but every one of them was answered easily and quickly, either by an article or a video in the Support pages.

YNAB 4: Summary

Okay, I will say this once more time:

If you need software to help you budget, track account balances, get your money under control, and get out of debt once and for all, then YNAB 4 is the best tool you will find. Period. Doesn't matter if you're following Dave Ramsey's "Baby Steps," or any other plan. YNAB is the budgeting tool that will allow you the best shot at getting there.

At , YNAB 4's price puts it in the Quicken ballpark, which isn't cheap. But it is still absolutely, positively the best budgeting software in existence as of this writing.

And. It's. Not. Even. Close.

| Ratings are scaled 1 to 5, with 5 as the top ranking. | |

|

value: Is it worth the money? |  |

|

adaptability: Could this work for me over time? |

|

|

usage: Is its usage intuitive? Is it professional in appearance and function? |

|