"Good luck with your layoffs, all right? I hope your firings go really well."

— Peter Gibbons, Office Space (1999)

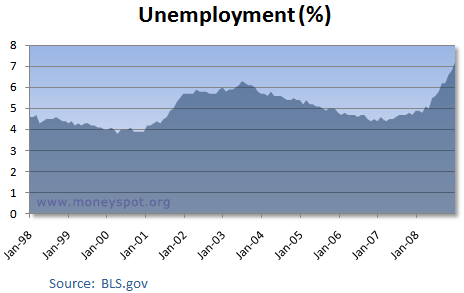

Data from the Bureau of Labor Statistics released this past Friday report that U.S. unemployment reached a level of 7.2 percent in December 2008. Know what this means to me?

It means that Emergency Funds are more important than ever.

Losing one's job is a massive financial jolt, obviously. But there are other ways in which macroeconomic stress can shred the household pocketbook. What about decreased hours at work? The number of people working part-time for economic reasons ("involuntarily," in other words) increased to 7.3 million in November 2008, according to another BLS report. That's an increase of 87 percent from a recent low of 3.9 million in April 2006.

Where these numbers become so troubling for me is when they're correlated with data regarding Americans and emergency savings. In July 2007, Bankrate conducted a savings survey with GfK Roper and found that 46 percent of Americans have at least a three-month savings cushion. Further, only a quarter of Americans who earned $30k or less had enough savings to cover expenses for three months.

Rising unemployment (and underemployment), coupled with savings figures like these, paints a fairly nasty picture.

Sadly, it usually takes troubled economic times like this to convince people of the importance of liquid savings and Emergency Funds. As long as things are grand and the money's coming in and your house is throwing off double-digit appreciation every year, saving is tomorrow's chore. Never today's.

Then your home ("Let your home start paying you back!") sheds 30 percent of its value.

Sellers slash the stock market almost in half.

Two of your neighbors get downsized.

Your credit lines get cut from $20k to $2k.

Your government resorts to bailouts du jour and unorthodox central-banking policies just to keep the economic train on the tracks.

World looks a little different now, doesn't it?

We'll see where things go from here. I'm glad to be debt-free except for my house, and we're tucking away chunks of cash every month.

Not what the gubmint wants us to do, of course. But then I consider most all of them to be just this side of idiots anyway.

Here's to saving.

Labels: Saving